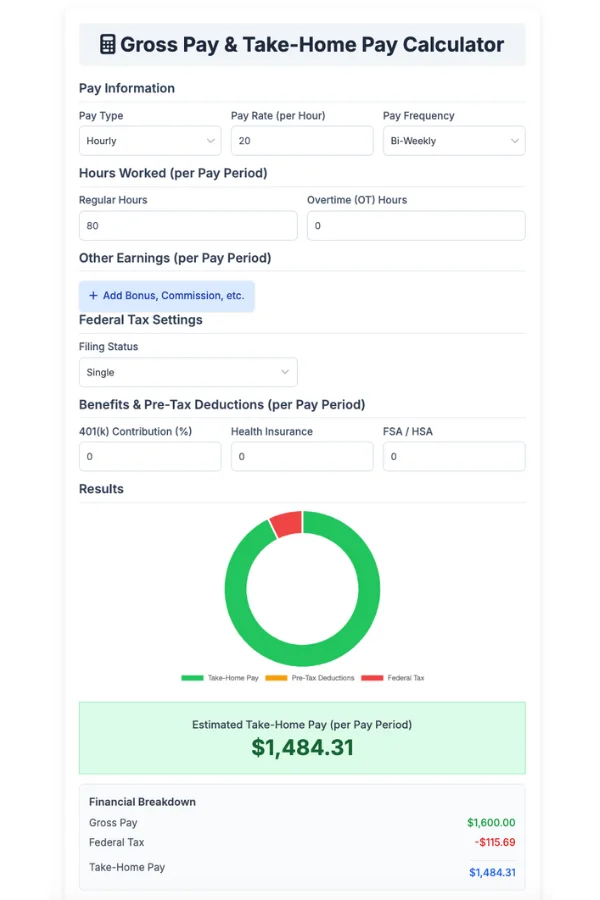

Pay Information

Hours Worked (per Pay Period)

Other Earnings (per Pay Period)

Federal Tax Settings

Benefits & Pre-Tax Deductions (per Pay Period)

Results

Financial Breakdown

How is this calculated?

Enter your pay and deduction information to see a detailed calculation.

Have you ever looked at your paycheck and felt a slight disconnect between the salary you were offered and the amount that actually landed in your bank account? You’re not alone. Understanding the journey your money takes from your employer to you is a cornerstone of financial literacy. It all begins with one fundamental figure: your gross pay. This article will serve as your comprehensive guide to mastering this concept, explaining what it is, why it matters, and how our powerful gross pay calculator can empower you to take control of your financial life. 🚀

What Exactly is Gross Pay? 💰

Before we dive into calculations, let’s establish a clear definition. Gross pay, also known as gross income, is the total amount of money you earn from your employer before any taxes or other deductions are subtracted. It’s the top-line number on your payslip, representing the full value of your work for a specific period. This figure includes your base salary or hourly wages, plus any additional earnings like overtime, bonuses, or commissions. Think of it as the starting point of your earnings journey.

Gross Pay vs. Net Pay: The Key Difference

It’s crucial to distinguish gross pay from net pay. While gross pay is your total, pre-deduction income, net pay is the actual amount you take home after all withholdings have been accounted for. This is often referred to as “take-home pay.” The deductions that bridge the gap between these two figures can include federal and state taxes, Social Security and Medicare contributions (FICA), health insurance premiums, and 401(k) contributions. Our tool functions not only as a gross salary calculator but also helps you see the impact of these deductions, effectively acting as a take home pay calculator.

Why Should You Use a Gross Pay Calculator? 🤔

Using a reliable gross income calculator is about more than just satisfying curiosity; it’s a strategic move for smart financial management. This tool provides the clarity needed to make informed decisions that can shape your financial future.

For Accurate Financial Planning and Budgeting

Your gross pay is the bedrock of your financial plan. When you create a budget based on your take-home pay alone, you miss the bigger picture. Understanding your gross income allows you to see exactly how much is going toward taxes and benefits, helping you plan for retirement and assess your true earning power. An annual gross income calculator is particularly useful for long-term planning, such as saving for a home or mapping out investment strategies.

To Compare and Evaluate Job Offers

When you’re weighing multiple job offers, comparing the base salaries isn’t always enough. A higher salary in a state with higher taxes might result in lower take-home pay than a slightly lower salary in a different state. By using a tool like an adp salary calculator or a similar comprehensive calculator, you can input different scenarios to see which offer is truly better for your bottom line. It allows you to look beyond the surface number and analyze the complete compensation package.

To Confidently Negotiate a Raise or Promotion

Knowledge is power, especially during salary negotiations. When you ask for a raise, knowing your numbers is essential. With a monthly gross income calculator, you can model how a potential increase will affect your gross pay and, subsequently, your net pay. This allows you to negotiate more effectively, armed with a clear understanding of what a certain percentage or dollar increase actually means for your finances.

A Step-by-Step Guide to Using Our Calculator 📝

Our calculator is designed to be intuitive and comprehensive. Follow these steps to get a detailed breakdown of your earnings.

Step 1: Enter Your Core Pay Information

First, tell the calculator about your primary source of income. In the Pay Information section, use the dropdown menu to select your Pay Type—either ‘Hourly’ or ‘Salary’. Then, input your hourly wage or your total annual salary. The final piece of this step is choosing your Pay Frequency, which tells the calculator if you are paid weekly, bi-weekly, or monthly. This is crucial for ensuring the calculations accurately reflect your paycheck schedule.

Step 2: Account for All Hours Worked

If you are an hourly employee, this step is for you. The Hours Worked section is where you log your time for the pay period. Enter your standard, non-overtime hours in the Regular Hours field. If you’ve worked extra, add those hours into the Overtime (OT) Hours field. The calculator automatically computes overtime at the standard 1.5x rate, ensuring your gross pay is accurate.

Step 3: Don’t Forget Other Earnings

Many compensation packages include more than just a base salary or wage. The Other Earnings section is where you can add any additional income you’ve received. This could be a performance bonus, a sales commission, or tips. Simply click the “Add” button to create a new line for each type of earning to get a complete picture of your total gross income for the period.

Step 4: Configure Your Federal Tax Settings

Now we begin the transition from gross to net. The first step is to configure your tax situation in the Federal Tax Settings. Choose your Filing Status from the options provided, such as ‘Single’ or ‘Married Filing Jointly’. This information is vital because it determines the standard deduction and federal income tax brackets that apply to you. Accurately estimating taxes is complex, which is why a robust calculator that can function as a talent tax calculator is so valuable.

Step 5: Input Your Benefits and Pre-Tax Deductions

Many employers offer benefits that are paid for with pre-tax dollars, which can lower your taxable income. In the Benefits & Pre-Tax Deductions section, you can input these amounts. Enter your 401(k) contribution as a percentage of your pay, and then add any fixed-dollar deductions for items like health insurance premiums or contributions to a Flexible Spending Account (FSA).

Step 6: Analyze Your Comprehensive Results

Once all your information is entered, the Results section instantly provides a detailed financial summary. You will see a dynamic chart that visually breaks down your earnings, showing what portion is take-home pay versus what goes to taxes and deductions. Below the chart, your estimated Take-Home Pay is clearly displayed. The Financial Breakdown card provides the specific numbers, turning the tool into an effective net income calculator. It allows you to see the flow from gross pay to net pay transparently.

Understanding the Journey from Gross to Net 🧐

The path from your gross salary to your take-home pay is paved with deductions. A net to gross calculator essentially works this process in reverse, but understanding the deductions themselves is key.

Common Deductions from Your Paycheck

The most significant deductions are typically taxes. This includes federal income tax, state and local taxes (which vary greatly, making a location-specific tool like an adp texas paycheck calculator useful for residents of that state), and FICA taxes, which fund Social Security and Medicare. In addition to taxes, you have your pre-tax deductions for benefits, which we discussed earlier. Finally, there can be post-tax deductions, such as contributions to a Roth 401(k) or wage garnishments. A comprehensive adp payroll calculator is designed to handle all of these variables with precision.

Conclusion: Take Command of Your Financial Future 🚀

Understanding your gross pay is the first, most crucial step toward financial empowerment. It enables you to budget effectively, plan for the future, compare career opportunities, and negotiate with confidence. By using our detailed and user-friendly gross pay calculator, you are no longer just a passive recipient of a paycheck. You become an informed and proactive manager of your own financial destiny. Go ahead, enter your numbers, and unlock the clarity you need to build a brighter financial future.